The Trust financial performance for the year ended 30 June 2017 is in the Financial Report and Financial Statements below.

The Trust made a net operating surplus of $2.5 million (before forest revaluation and tax). Despite the impressive stumpage figure, the high costs involved in developing the new forest lands impacted on the operating profit for the Trust.

Forest values increased overall by $6.1 million, to $37.7 million in 2017. The Trust’s wholly owned forest is valued at $19.9 million, while the value of the Trust’s share of the lease forest for the same period is $17.8 million. For details of the forest valuation see the Forestry Report.

Stumpage

Total stumpage income for the year is $4.2 million, which is a 3 per cent decrease from the previous year, but still a very high return for the Trust. Details of the stumpage and harvest 2017 are in the Forestry Report.

Investments

Investment income in the form of interest and dividends and movements in market valuation returned $0.88 million. The Trust investment portfolios are managed by Taupō Moana Funds.

A total of 63 per cent of investment funds are held in money market and fixed interest securities (stocks and bonds). By holding most of the funds in low-risk income sectors the investment portfolio remains more secure. The remaining 37 per cent is held in Australasian, international equities and property investments.

Investment in The Weighbridge Company Limited

In 2005 the Trustees of Lake Rotoaira Forest Trust entered into a joint venture agreement with Lake Taupō Forest Trust to build and operate a weigh-bridge. Lake Rotoaira Forest Trust has a 25 per cent shareholding in The Weighbridge Company Limited, which began trading in July 2004. This year, 25 per cent of the net before tax surplus of The Weighbridge Company is included in the income of Lake Rotoaira Forest Trust: $13,591. A dividend of $33,487 was received from The Weighbridge Company in this period also.

Investment in Lake Taupō Forest Management Limited

Lake Taupo Forest Management Limited was incorporated on 22 March, 2001. The principal activity of the Lake Taupō Forest Management is forest management, consultancy and advice. At 30 June 2011, Lake Rotoaira Forest Trust bought a 30 per cent shareholding in Lake Taupō Forest Management for $15,000. This year, 30 per cent of the net before tax surplus of Lake Taupō Forest Management Limited is included in the income of Lake Rotoaira Forest Trust ($100,212).

Investment in Lake Rotoaira Forest Trust Land Holdings Limited

Lake Rotoaira Forest Trust Land Holdings Limited was incorporated on 13 August, 2013. It is a subsidiary of Lake Rotoaira Forest Trust, and its principal activity is to hold freehold lands and transactions on behalf of the Trust. In October 2013, Lake Rotoaira Forest Trust Land Holdings entered into a limited partnership arrangement with Tūwharetoa Settlement Trust Limited Partnership, investing $300,000 to take a 4 per cent shareholding in the Department of Education property leases in Taupō. In October 2016, Trustees resolved to increase their investment in the Tūwharetoa Settlement Trust Education properties. Accordingly, Lake Rotoaira Forest Trust advanced $200,010 to LRFT Land Holdings. This advance was made interest free and is repayable on demand. Dividends of $25,497 were received for the year ending 30 June, 2017.

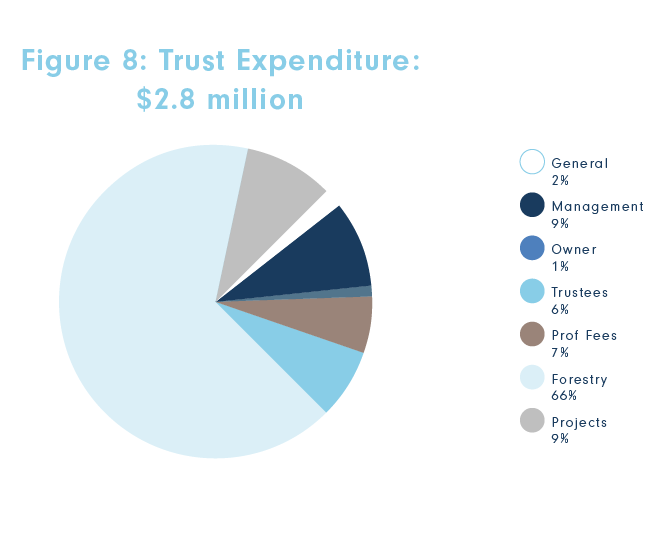

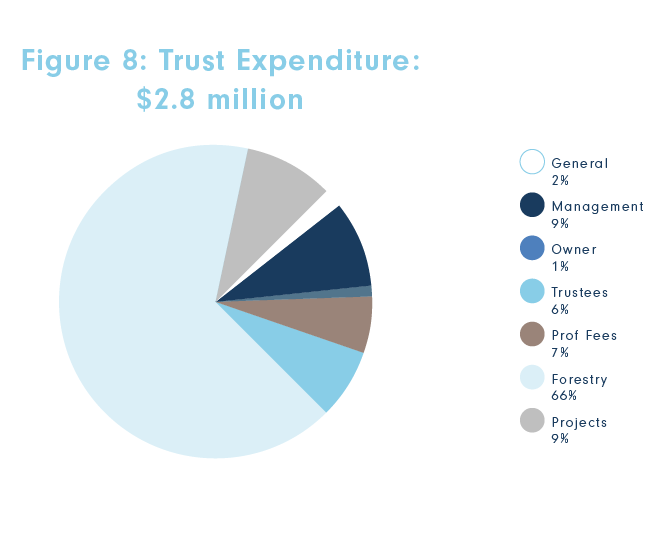

Total operating expenses decreased by 10 per cent on the previous year to $2.8 million. In total, 66 per cent of the Trust costs are related to direct forest costs, while the balance of expenditure relates to general expenses of administering the Trust and communicating with owners. During this year, the project manager, Tiwana Tibble, continued his work looking into other commercial opportunities for the Trust. Figure 8 shows how each expense category contributed to total expenditure.

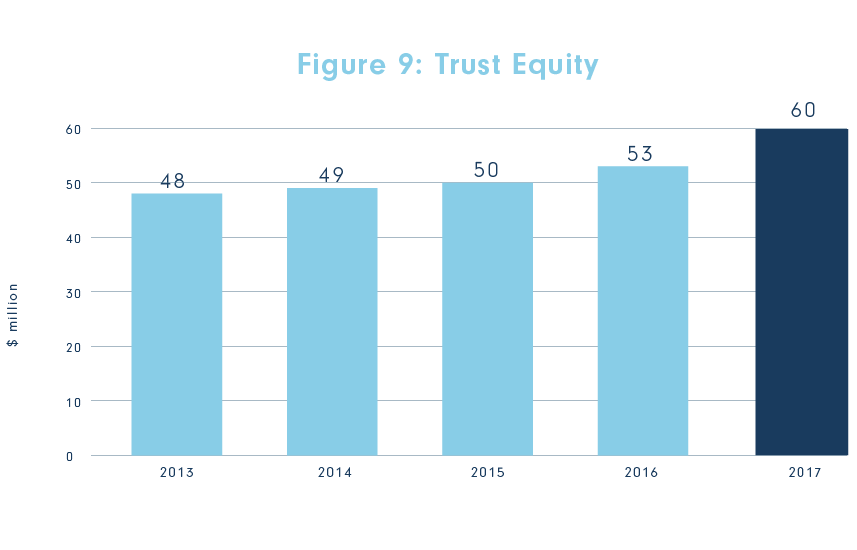

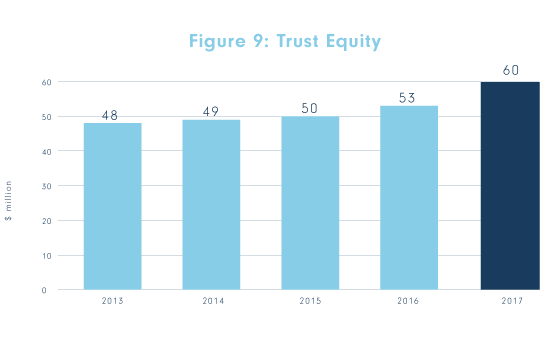

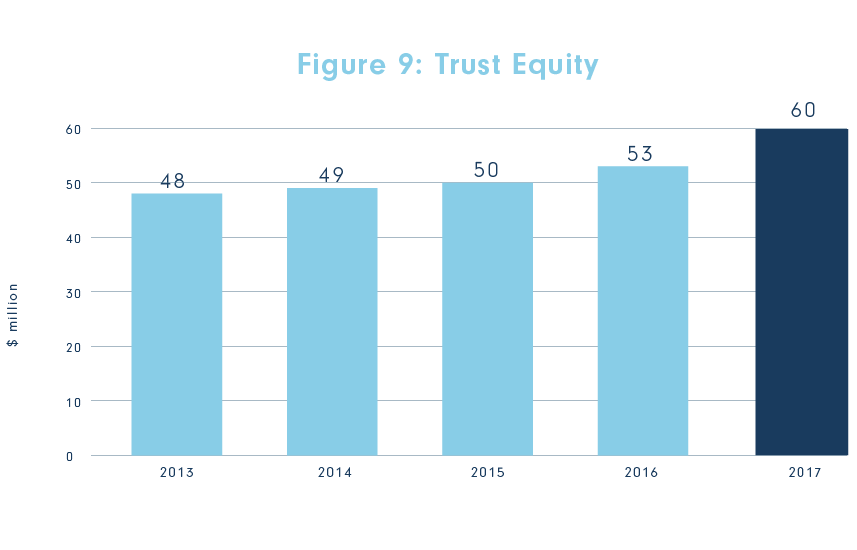

Trust equity increased from $53 million to $60 million. This movement in equity represents the increase in profit and forest valuation less the annual distribution, which was $0.75 million this year. Lake Rotoaira Forest Trustees take a long-term view and focus on obtaining the utmost value for money from their harvesting regime while maintaining full ownership in their lands.

The Trust has continued to maintain investment accounts for the Rangipō North Blocks. At the end of the 2017 financial year, the market value of Rangipō North 3C and 5C investments were $5,383 and $2,605 respectively. During the 2016 year, Trustees declared a distribution to the owners in these blocks. These funds are managed independently by Taupō Moana Funds.

The Trustees are pleased to present the Full Financial Statements of the Lake Rotoaira Forest Trust for the 12 months ended 30 June 2017. Authorised for and on behalf of the Board of Trustees on 5 December 2017.

The Full Financial Statements can be downloaded as a pdf here.