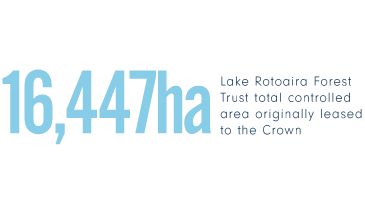

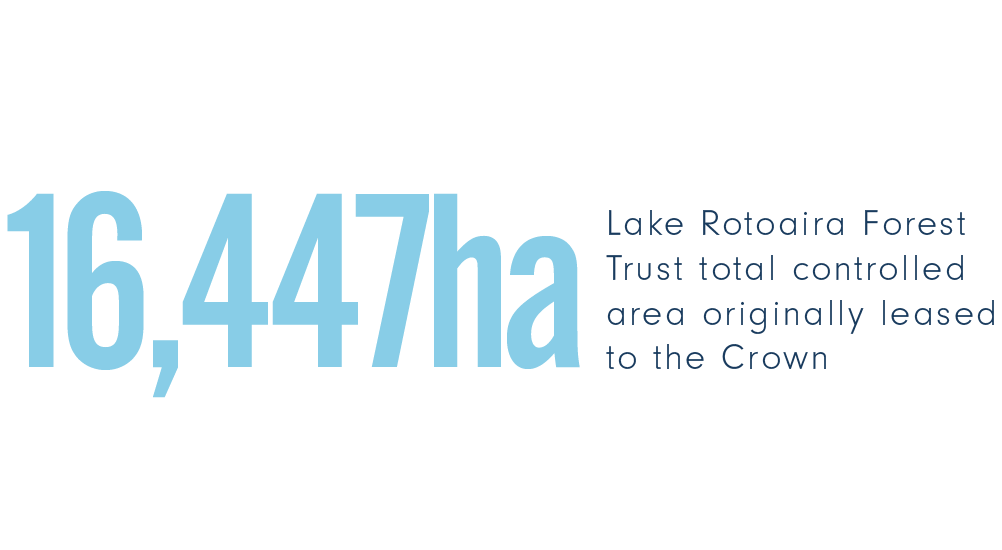

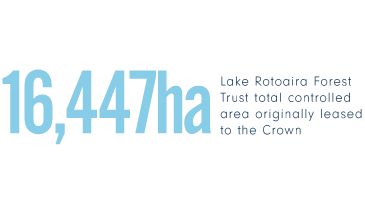

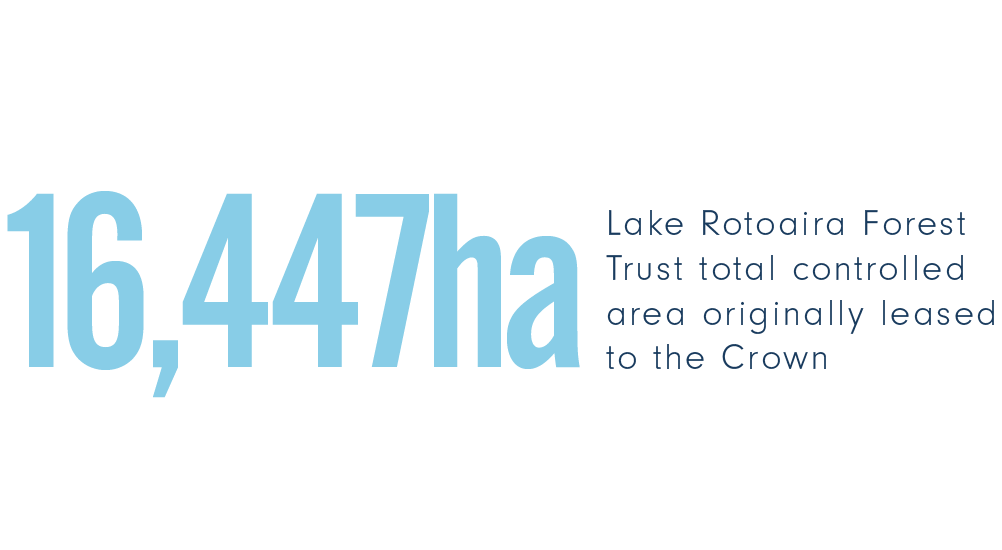

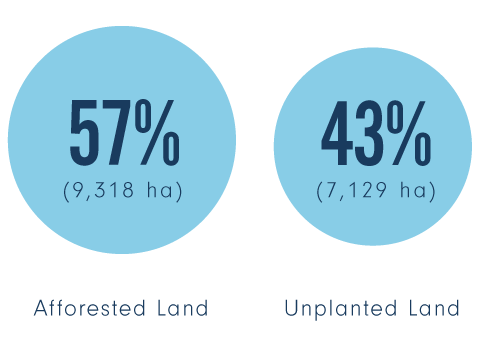

The Lake Rotoaira Forest Trust controls an area of 16,447 hectares, which is the area originally leased to the Crown for forestry (the Schedule 1 blocks). In addition, the Trust administers 1,260 hectares of land (Schedule 2 blocks) located around the edges of Lake Rotoaira and 6,350 hectares of land (Schedule 3 blocks) along the Desert Road.

The Lake Rotoaira Forest Trust controls an area of 16,447 hectares, which is the area originally leased to the Crown for forestry (the Schedule 1 blocks). In addition, the Trust administers 1,260 hectares of land (Schedule 2 blocks) located around the edges of Lake Rotoaira and 6,350 hectares of land (Schedule 3 blocks) along the Desert Road. These blocks are under the Trust for administrative purposes only and do not contribute to the Trust’s forestry business. Further information on the Trust and its lands can be found at www.lrft.co.nz.

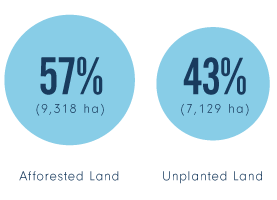

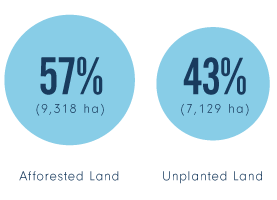

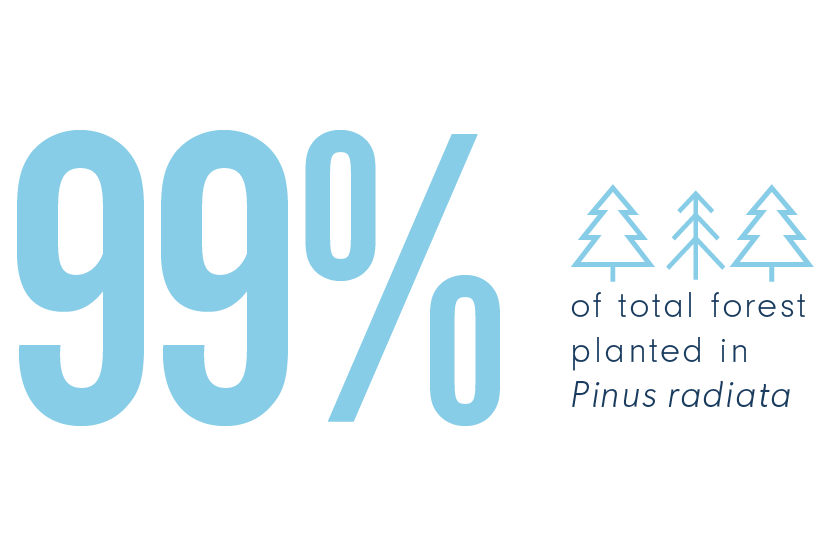

Of these 16,447 hectares, 9,318 (57 per cent) have been afforested. Having 43 per cent unplanted is unusual in New Zealand plantations, and it reflects the conservation and environmental protection desires of the owners and the Crown, which are embodied in the lease agreement.

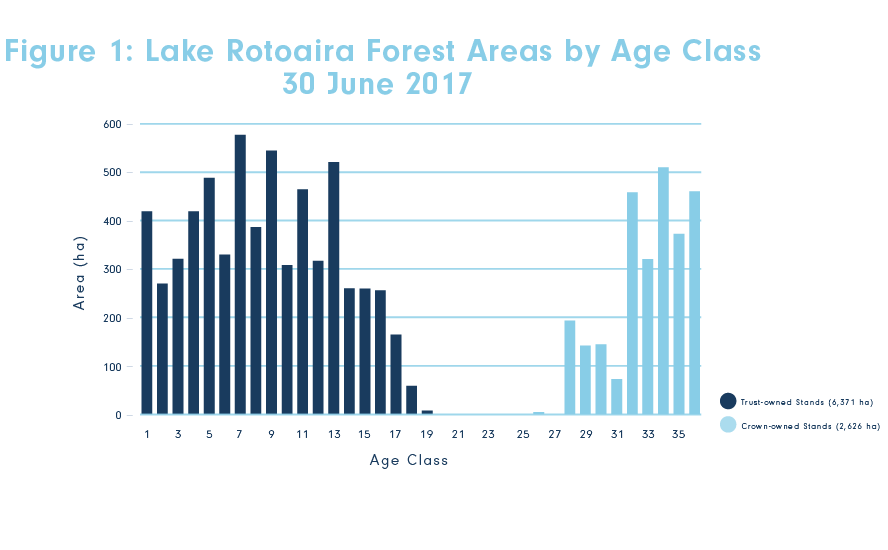

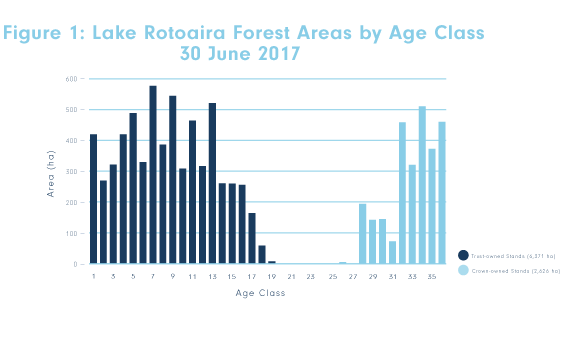

The land was originally leased to the Crown in 1973 for 70 years – long enough to grow two rotations of pine trees. In 2002, the Crown’s lease was changed to make it a one rotation lease, and as a result, leased land is now returned to the Trust following the harvest of the first rotation crop. Consequently, the Trust now owns 6,371 hectares of planted, second rotation forest. This represents 68 per cent of the total planted area in Lake Rotoaira Forest, with the Crown owning the remainder.

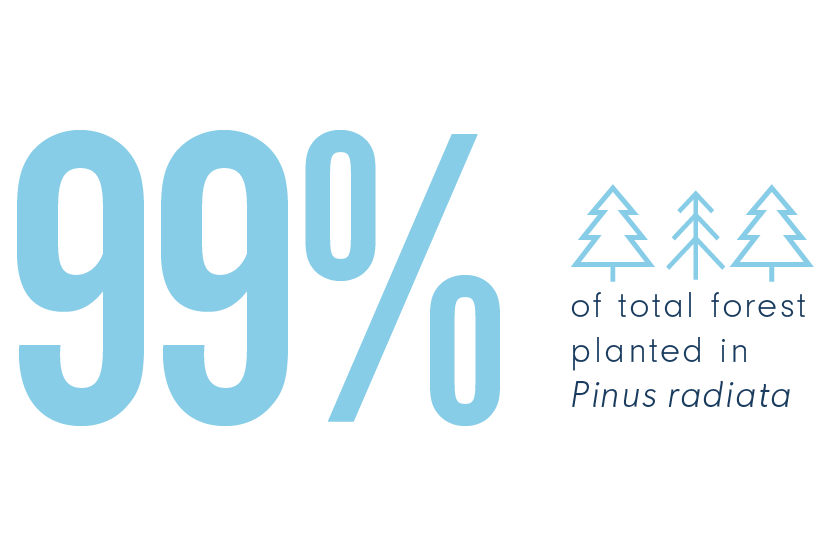

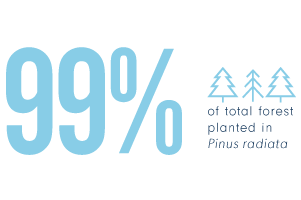

Almost 99 per cent of the forest is planted in Pinus radiata, and the remaining stands comprise mainly Douglas fir, eucalyptus and larch. Planting commenced in 1973 and was effectively completed by 1989. Harvesting commenced in 1999, and the harvested areas are being replanted each year, thus creating the second rotation crop.

The Trust is responsible for the management of the second rotation forest (currently 5,950 hectares). This Trust-owned forest is managed under contract by NZ Forest Managers Ltd (NZFM), whose work is audited on behalf of the Trust by Lake Taupō Forest Management Ltd.

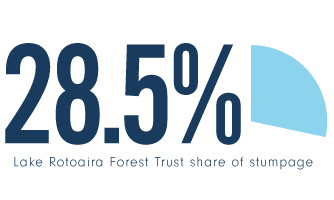

Management of the lease forest (i.e., the first rotation crop – approximately 2,630 hectares remaining) is the responsibility of the Crown through the Ministry of Primary Industries (MPI). NZ Forest Managers has also been contracted by the Crown to carry out the day-to-day management of the lease forest, including the harvesting and marketing of the mature trees. The Trust receives a 28.5 per cent share of the profit (stumpage) from the sale of these harvested trees.

NZ Forest Managers has managed the forest since the early 1990s. Some of its staff members’ involvement with the forest pre-dates that as they were involved in managing the forest on behalf of the New Zealand Forest Service. The institutional knowledge built up by NZ Forest Managers is of great benefit in ensuring that the second rotation crop is managed to its maximum potential. The Trust is very satisfied with the quality of NZ Forest Managers’ management and the working relationship it has with the company. The owners can be reassured that the cultural sensitivities of leasing their land, such as respecting and protecting any wāhi tapu, are well understood by the managers and are considered in all operational work undertaken.

All of the first rotation Pinus radiata stands have undergone intensive pruning and thinning regimes. Initially, production thinning was carried out on the gentler slopes, while thinning to waste was carried out on steep country. Today, no production thinning is undertaken.

The establishment and management of the second rotation crop are progressing well. A further 419 hectares were planted in the winter of 2016 on the land harvested and then surrendered from the Crown lease in the previous year. The Trust is continuing with its policy of thorough land preparation and planting of high-quality seed stock.

‘The Trust is continuing with its policy of thorough land preparation and planting of high-quality seed stock.’

The Trust spent a total of $1.86 million on establishing and managing its forest in 2016–17, which was on budget though about $200,000 below the average of the previous three years. We can expect this sort of variation to continue in future years, mainly as a reflection of the differences in areas planted each year as shown in the age class graph. Around 40 per cent of the expenditure related to land preparation, planting and releasing (controlling the weeds around the young plants), with pruning accounting for a further third of the cost.

Around 70 per cent of the second rotation crop is managed under a clearwood (pruning) regime, entailing two or three pruning operations typically between ages 5 and 10 years. We continue to analyse what level of pruning investment is right for us. Several of the larger forest growers in the central North Island region have stopped pruning altogether, but we do not think this is appropriate for our forest.

The main reason for investing so much in pruning is the expectation that the investment will be more than paid back when the logs are harvested. For pruning to be profitable, the price of pruned logs needs to be substantially higher than that of large unpruned sawlogs. Our analysis of historic log prices indicates that this hasn’t always been the case, but the current high pruned-log prices are encouraging. Pruning profitability is also influenced by the growth rates, and we tend not to prune the less productive sites as the slower tree growth reduces the return on the pruning investment. Similarly, the stands on some sites have a history of wind damage, due to their specific geography. We can reasonably expect more such wind events over time, so we generally do not invest in pruning these areas. Instead, these sites are managed on a framing (non-pruning) regime.

In addition to the straight financial analysis of whether or not to prune, we are acutely aware of the social implications of reducing this work, knowing that most of the people working in the pruning crews are our owners. We are aware that these same crews also undertake our planting work in the winter months. If we significantly reduced our pruning programme, we would need to find workers for three months to do the planting, which we know would be challenging.

‘We are acutely aware of the social implications of reducing this work, knowing that most of the people working in the pruning crews are our owners.’

The logs harvested in Lake Rotoaira Forest come from the Crown Lease forest. The Trust’s own forests will not be ready for harvesting until 2026. NZ Forest Managers has the responsibility to market the logs on behalf of the Crown and Trust.

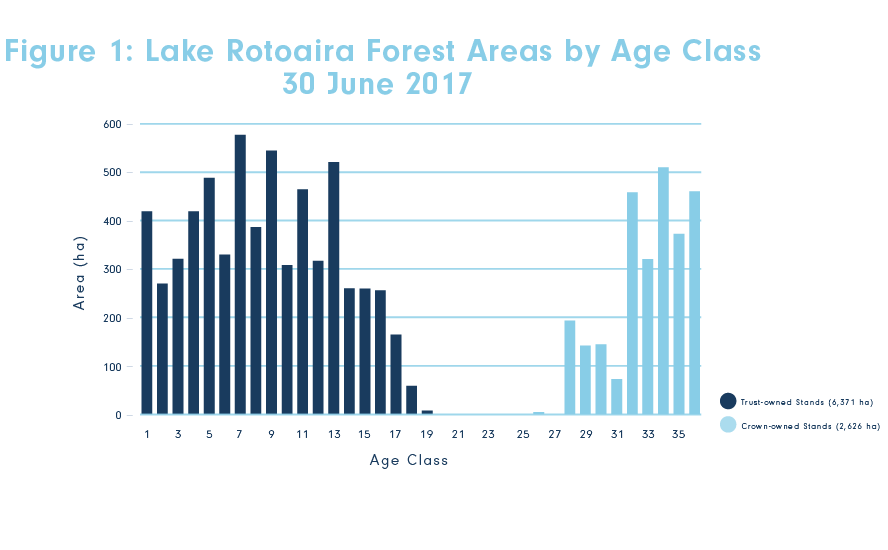

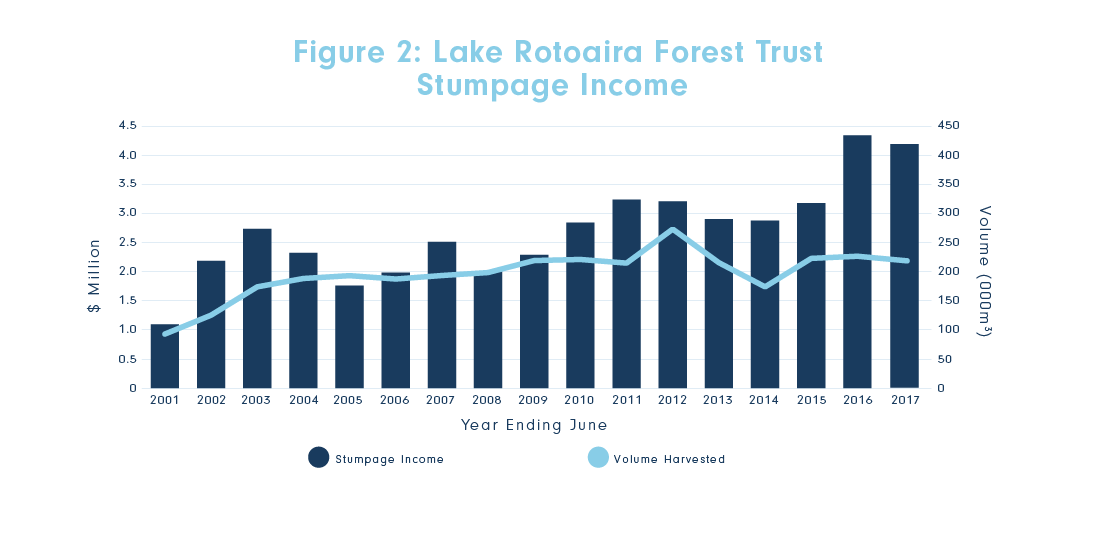

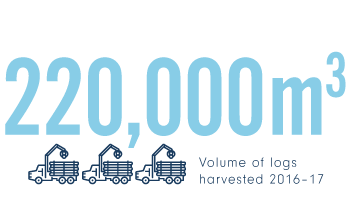

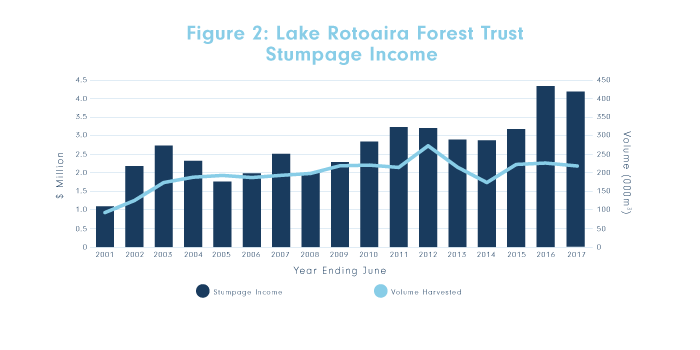

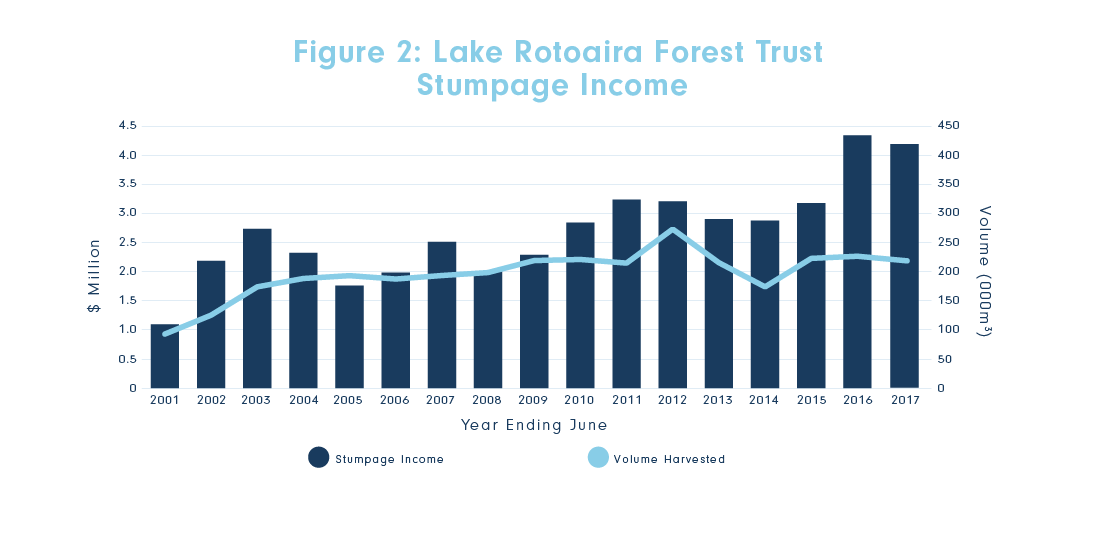

Harvesting in Lake Rotoaira Forest commenced in 1999, and it climbed to an annual rate of 180,000 m³ in 2002–03. Re-assessment of growth rates in 2009 indicated that a cut of around 209,000 m³/annum is sustainable. However, in any year, we can expect the actual volume to range around this amount by 20,000–30,000 m³.

A total volume of 220,000 m³ was harvested in 2016–17, which was slightly above the sustainable level but within the normal range. The harvesting is generally concentrated in Oraukura and Ruamata blocks to the north-west of Lake Otamangakau.

The total stumpage income for Lake Rotoaira Forest in 2016–17 was $14.7 million. As prescribed in the lease, the Lake Rotoaira Forest Trust received a 28.5 per cent share of this income, receiving $4.2 million in stumpage income for the year. This is about 3 per cent less than in the previous year, but it is from a harvested volume that was also 3 per cent lower than the previous year.

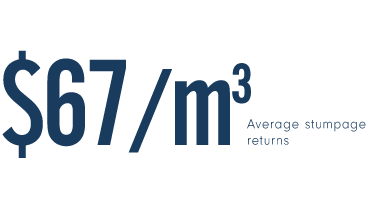

By historic standards, the total stumpage income in 2016–17 was very high. On a per cubic metre basis, the average stumpage returns of around $67/m³ matched the previous year’s record high and were well above the 10-year average of $50/m³. This is a reflection of the strong market conditions through most of the year, which is discussed later.

‘Average stumpage returns of around $67/m³ matched the previous year’s record high.’

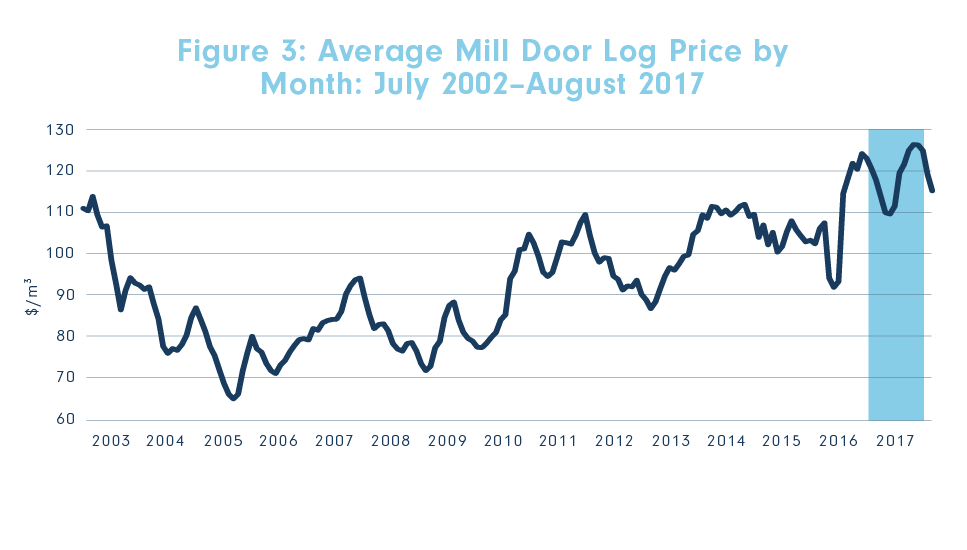

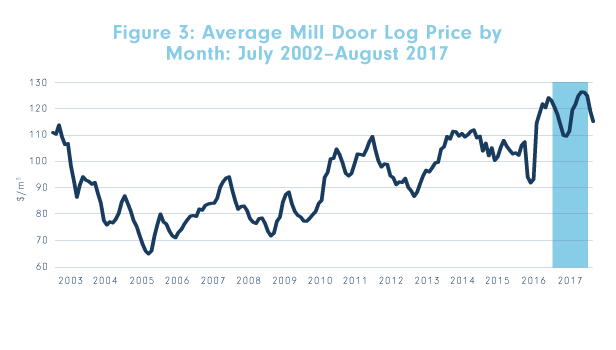

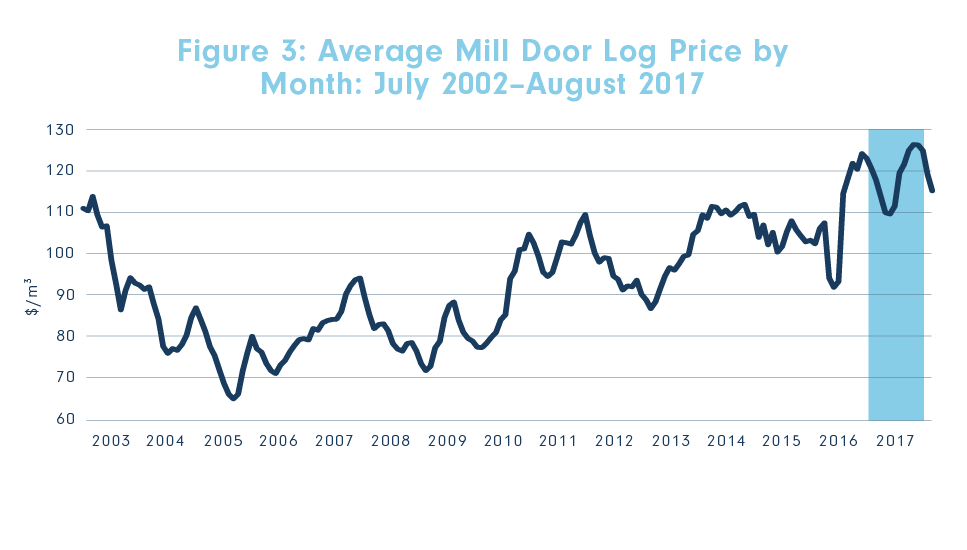

The 2016–17 year saw a variety of influences on the returns we got from the logs we sold. The log prices are obviously a key determinant of this, and the average sales price across all grades of $125/m³ was a record high for the forest.

Again it has been China that has dominated the market demand for New Zealand radiata. Around half of all logs harvested in New Zealand are exported in log form to China. While the Trust does not sell any logs into China, the prices paid by Chinese customers largely dictated the prices paid in other markets – including the domestic New Zealand market – for most unpruned log grades (which comprise around 65 per cent of our logs).

‘China’s demand for wood remained steady throughout the year, and prices held up well.’

China’s demand for wood remained steady through-out the year, and prices held up well. Further assisting our returns was the relatively low New Zealand dollar against the United States dollar, which averaged around $0.72 for the year, and as export sales are traded in United States dollars, this had a positive impact on the returns we received. When coupled with continued low ocean freight rates (reflecting the downturn in international trade of most commodities), everything aligned well for forest owners to receive high returns.

While some of the radiata exported to China is remanufactured and then re-exported, much continues to be put into low-end uses such as concrete boxing, pallets and packaging. Despite this, China still provides the best returns for much of New Zealand’s wood, and it can also absorb the high volumes being harvested throughout the country. However, there is a feeling in the industry that we will have to create higher value end-uses for radiata if it is to improve returns to the growers. Changing this will take time, and it really needs a pan-industry approach. There are signs that the NZ forest industry is starting to cooperate more usefully, and we hope that international market development work will get some attention in the near future.

South Korea is a steady purchaser of New Zealand logs, though not at the high volumes of a decade ago. We sell wood into Korea through DK Korea, their largest importer, with whom we have been trading for over 20 years. Japan also continues to be steady buyers of New Zealand radiata logs, and we have a long and strong relationship with the country’s largest radiata buyer, Orvis.

India has also increased its demand for radiata logs over the last few years, and it is currently the third largest buyer of New Zealand’s logs. However, demand from India can be fickle, with the buyers very much driven by price rather than quality. We have been selling logs into India for six years now, in a joint arrangement with Rayonier, and this is working well.

Most logs from Lake Rotoaira Forest are sold within New Zealand, and prices paid by our dom-estic customers (mainly sawmills and pulp mills) followed the initial fall and then rise in prices over the year. Figure 3 presents the average price received for Lake Rotoaira Forest logs (domestic and export sales) since 2002, with 2016–17 shown in the blue band.

Log exports comprised 28 per cent of the annual sales from Lake Rotoaira Forest in 2016–17, which is a typical proportion for the forest. A further 4 per cent of the log volume was sold to New Zealand agents who then exported the logs.

However, despite 68 per cent of the logs being sold domestically, the prices we receive are largely determined by international market factors. This reflects the fact that logs are an international commodity, and although some distance away from our main competitors, we are certainly not operating in isolation from their influence. Further, most of the product sold to New Zealand sawmills will eventually end up being exported in one form or another, so it must also compete on the international market.

Log prices in the first few months of the 2017–18 financial year have maintained the high levels of last year, and we are optimistic that this will persist for some time. However, we do expect our average production costs will increase this year, mainly as a larger proportion of trees are being harvested on steep land, which incurs higher costs. Consequently, the 2017–18 stumpage income is predicted to be a bit lower than that achieved in 2016–17.

‘Log prices in the first few months of the 2017–18 financial year have maintained the high levels of last year, and we are optimistic that this will persist for some time.’

Wood from Lake Rotoaira Forest must also compete with other growers in the central North Island region. While we have no concerns about competing on quality – indeed our wood has a very good reputation in this regard – the sheer volume of wood in the region makes competition strong. Over the last few decades, the region’s increase in annual harvest volume has been larger than its increase in wood processing capacity, which has led to increased log exports. This increased harvest volume has been exacerbated in the last few years by high log prices.

The Trust is continually trying to encourage new players to enter the processing industry in this region. While there have not been any new mills built recently, there have been a few significant upgrades completed – the Red Stag mill, mentioned earlier, and also Sequal Lumber in Kawerau. As mentioned last year, Lumbercube mill in Rotorua closed in mid-2016.

Like the other major forest owners, we like to maintain some tension between the export and domestic markets as we see this as the best way to maximise returns from our logs. If either market dominated too heavily, forest growers, such as the Trust, would be in a weak position when negotiating log sales prices.

The significant drop in harvest in many Asian countries coupled with the steady increase in wealth (and wood consumption) of those countries are very positive signals for our future markets. The responsible and sustainable management of forests such as Lake Rotoaira Forest is gradually beginning to be recognised as an important factor in the marketability of our produce, with more and more buyers demanding Forest Stewardship Council (FSC) certified wood. Similarly, there is a gradual recognition of the environmentally friendly characteristics of wood as a building material compared with most alternatives, such as concrete and steel, though this is not expected to show through in any dramatic increases in prices in the short term.

Of course not all signs are positive. The competition from plantations in South America will continue to influence our markets, particularly in North America. Gradual increases in all sorts of regulation in New Zealand impact on our costs, as will high oil prices, if and when they rise from their current lows.

As always, the business of forestry remains somewhat an act of faith, and one that requires a long-term outlook. Money needs to be spent and land committed around 30 years before the time of sale. It is impossible to predict accurately how markets will look at such a time. The Trustees continue to look closely at the current situation and appraise future signals. We remain confident that the long-term outlook for forestry is positive and that plantations are the best use for most of the Trust lands. Overall, plantation forestry as practised by Lake Rotoaira Forest Trust is considered to be a safe and steady investment that will produce good returns for its owners.

The Trust is required to assess the value of its forest each year. This year, international forest consulting company Indufor Asia Pacific Ltd again undertook an independent valuation of our forest assets. The valuation modelled the long-term management and harvesting plans to determine future cash flows and extracted from that the current value of the Trust’s share of the Crown lease forest and the value of the Trust’s wholly owned forest.

These forest values are required for accounting purposes only (book values); more important to the Trust’s business is the annual cash flow, which mainly depends on the state of the log markets during any given year. The valuation represents the amount an independent buyer would pay to purchase our forests – not a situation which we envisage happening.

The valuation methodology for the forest remained the same as in the previous year, including the application of an 8.0 per cent discount rate on the forecast pre-tax cash flows.

The Trust’s wholly owned forest, with a total planted area of 6,371 hectares, was valued at $19.93 million at 30 June 2017. This was a $5.6 million increase on the value at June 2016. The rise in value was partly due to the area increasing by 419 hectares, which was the area replanted during the winter of 2016. The rest of the forest grew one year older, thus one year closer to harvest, and this also increases its value. The considerable sum spent on the forest this year (around $1.0 million, excluding that spent on the 2016 plantings) also contributed to its higher value.

The value of the Trust’s share of the lease forest at 30 June 2017 was $17.8 million, some $0.6 million (4 per cent) higher than at 30 June 2015. In normal years, we can expect this value to decrease as the remaining lease forest is steadily harvested through to 2026. However, this year, the value increased, reflecting the buoyant outlook for log prices over the remaining lease period.

The combined value of all of the Trust’s forest assets at 30 June 2017 is $37.72 million. This is 20 per cent higher than 12 months earlier. This value excludes the value of the land on which the trees are growing.

‘The combined value of all of the Trust’s forest assets at 30 June 2017 is $37.72 million.’

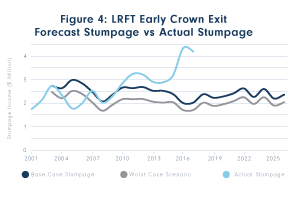

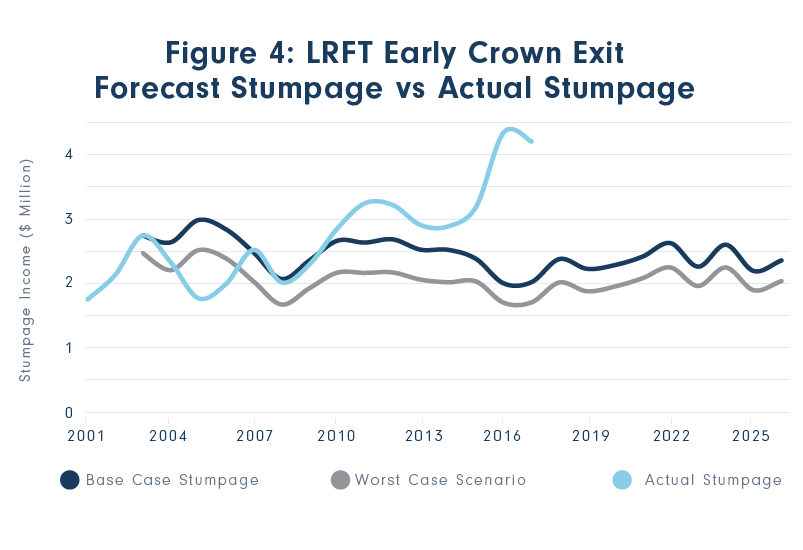

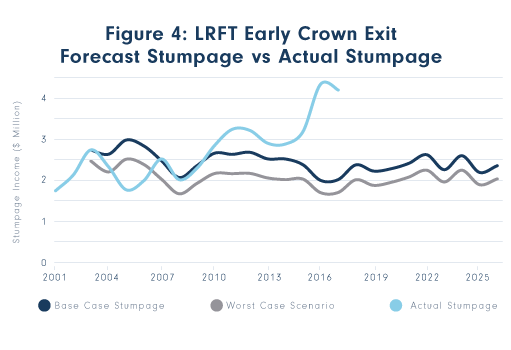

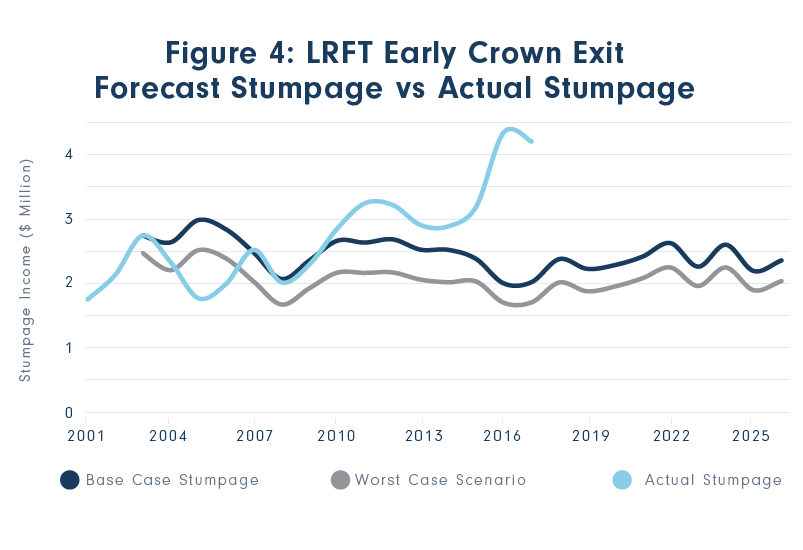

The Trust is now 15 years into the planned 24-year period during which the Crown is to exit its involvement in the forest. When considering the Lease Variation in 2002, Lake Taupō Forest Management calculated a worst case scenario that reflected the expected risks of taking on the obligation to replant and manage the second rotation crop. The risks included poor log prices, high costs, and damage from wind, fire and disease, and these events were quantified in terms of their potential impact on stumpage income. It was determined that Lake Rotoaira Forest Trust could afford the worst case scenario provided it had sufficient funds invested off-forest to use as a back-up.

The variable market conditions since 2002 have seen the Trust’s stumpage income falling below the forecast worst case scenario level and then returning to the base case level. Stumpage income has steadily improved over the last six years, and as a result, income has risen above the base case level (Figure 4). Further assisting this has been the higher total harvest able to be sustained by the forest. In 2002, we forecast log sales to be 180,000 m³/year, but as discussed earlier, we now estimate the forest can sustain a cut of 209,000 m³/year, and annual income will rise accordingly.

The strong returns of the last two years have clearly improved the Trust’s cash flow, but this graph only shows the income side. Forest costs have also increased over time, and the Trust has also invested in things not envisaged in 2002, such as the Hautū Rangipō lands and shares in a forestry lease on Opepe Farm Trust lands.

As mentioned earlier, the steep land in the western part of Lake Rotoaira Forest will comprise around one third of all harvesting in the forest over the next five or six years. The higher cost of these operations will impact on our net returns over that period. It appears likely that our stumpage income in upcoming years will not be so significantly above the base case forecast as it has been in the last two years. However, we remain confident that our overall business plans are affordable.

To cover the ongoing costs in the event of poor returns, the Trust has built up a forestry reserve fund from past savings, and this fund is managed by the Taupō Moana Group. The Trust calculated how much money would be needed in that fund at any time to ensure that even if the worst case scenario eventuated, it would have enough funds to cover ongoing costs of replanting and management and ensure that distributions could continue.

The amount required is updated periodically to account for changes in forecast costs and revenue. The latest update indicated that costs have increased considerably across most aspects of forest expenditure, but particularly transport costs. The Trust’s forestry and land investments in Hautū Rangipō lands and Opepe Farm Trust lands (discussed later) put further pressure on the Trust’s cash flows, particularly as these forestry investments will take 30 years before generating income.

The good stumpage returns in 2016–17 coupled with the fund itself earning around $150,000 in interest meant the balance in the Trust’s forestry reserve fund rose to $8.1 million by 30 June 2017. This is around $1.3 million higher than the 2016 balance. Our long-term forecasts indicate that the Trust is likely to use up most or all of these reserve funds by the time the Crown lease concludes in 2026. However, we remain confident that our forest investment and distribution strategy is affordable. Clearly though, we will need to continue to carefully monitor all aspects of expenditure.

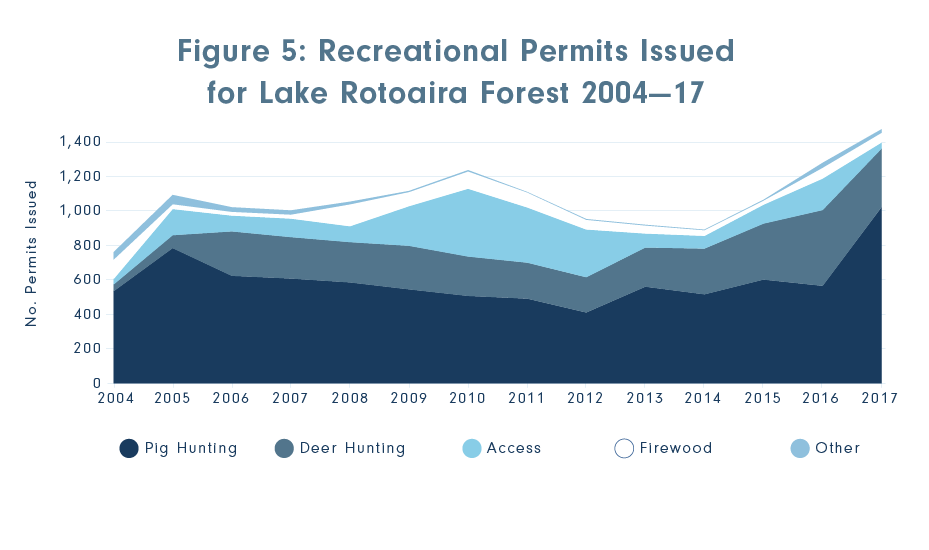

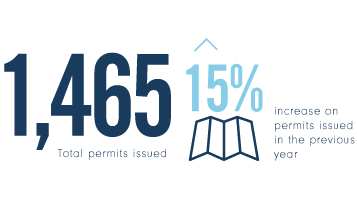

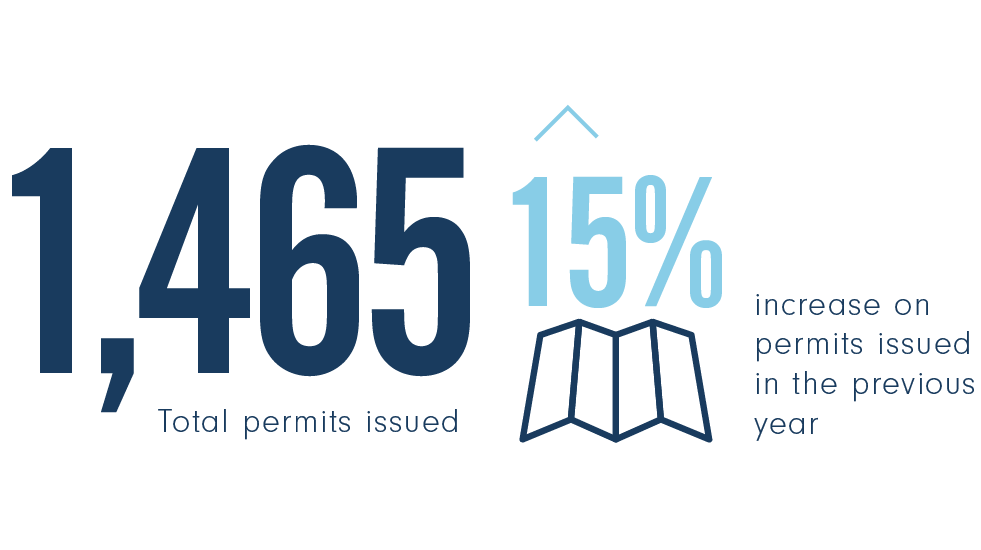

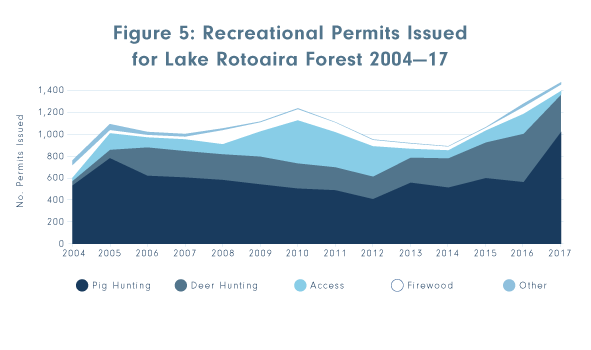

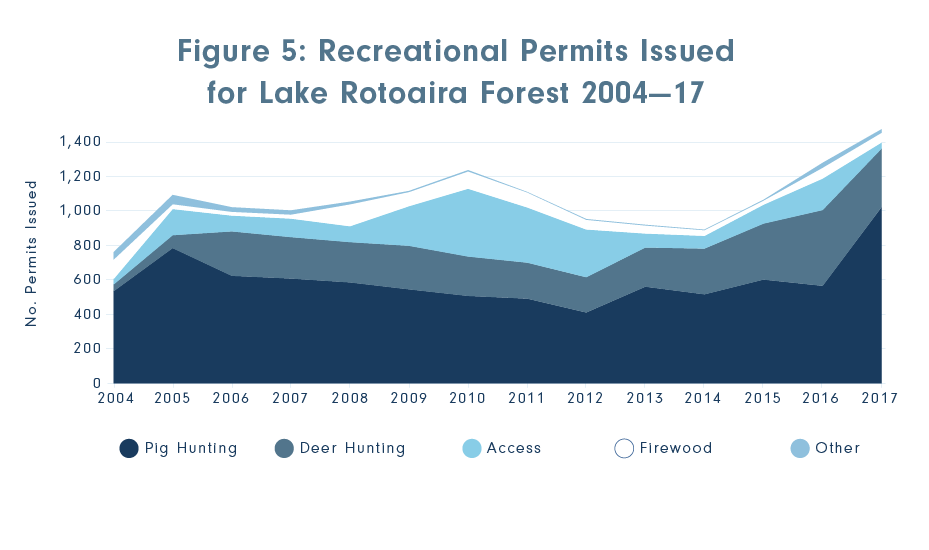

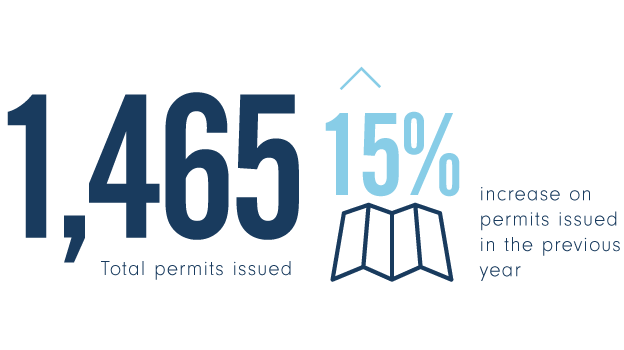

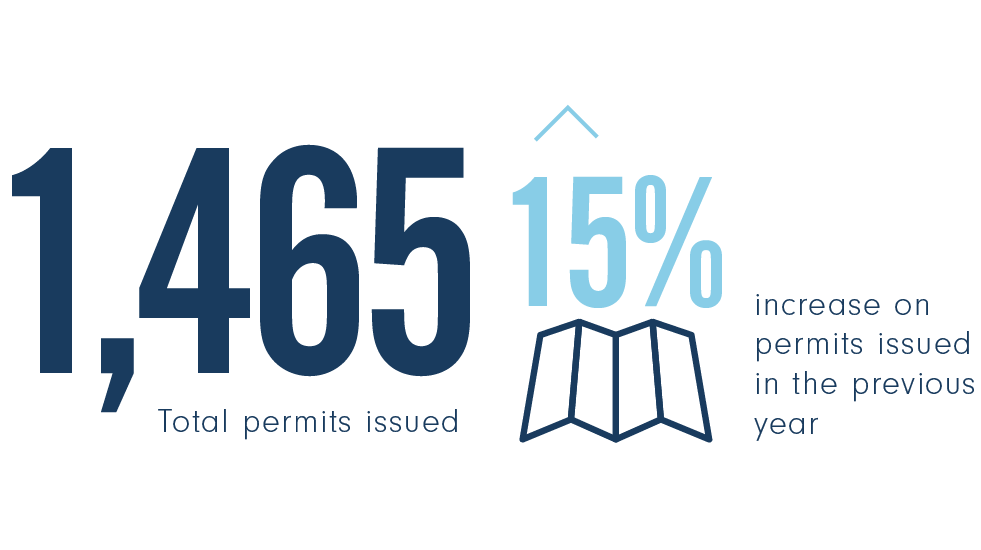

A total of 1,465 permits were issued to owners or descendants of owners during 2016–17, which continued a recent trend of increases in overall permit numbers.

Owner access permits to Lake Rotoaira Forest lands were obtained by 501 individuals during the year. While nearly half of these obtained only one permit during the year, 22 people received 10 or more permits in the 12-month period. The Trustees are pleased to see that access onto the lands continues to be important to so many owners and that strong connections with the whenua are being maintained.

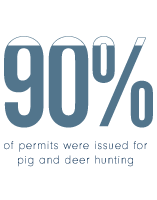

Hunting continues to be the most common activity for which owners request permits, with pig and deer hunting accounting for around 90 per cent of last year’s permits (Figure 5).

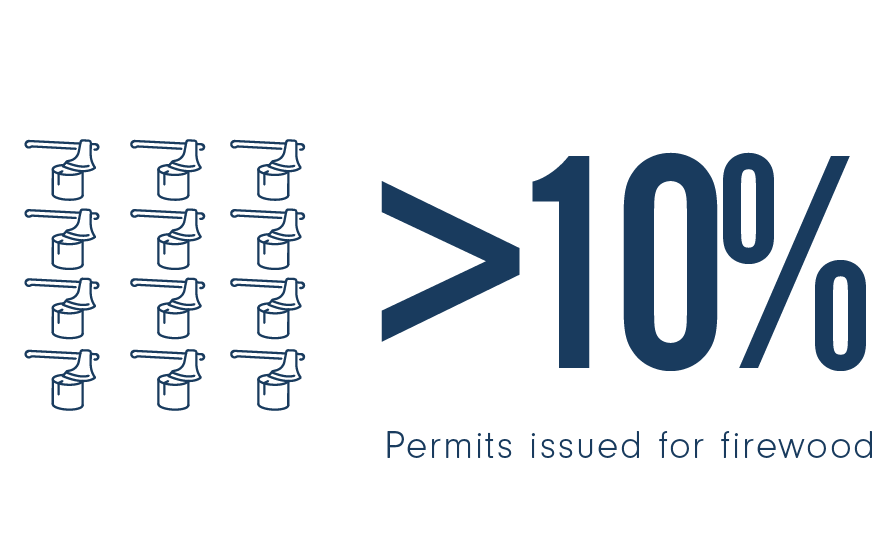

While collection of firewood is given as the main reason for access by less than 10 per cent of those seeking permits, we know that it is a far more important reason than this implies. Notes written when permits are given indicate that over half of those going onto the land also want to collect firewood, even though this may not be their primary reason for access.

Owners are reminded that firewood may only be taken from the forest’s designated firewood yard, which is located at the northern end of Papakai Road. The Trust has also been delivering firewood logs to a number of marae in the area, and some owners may prefer to get their firewood from there.

Owners, their descendants and spouses of owners are eligible for permits. To obtain a permit, a person must first register with the Trust office and provide various details to determine eligibility for access. Once that has been done, permits can be obtained at any time from the Trust office, our forest manager’s office (NZ Forest Managers Ltd – Atirau Road, Tūrangi) or the Tūwharetoa Māori Trust Board office (81 Horomatangi Street, Taupō). Permits remain valid for one month.

Change in Recreational Access Hours

From 1 December 2017, the Lake Rotoaira and Lake Taupō forest trusts are restricting the hours of recreational access to their lands to:

The new Health and Safety Act has led the Trusts to take legal advice on our operations in general, including our recreational policies. The advice has made it clear that our current rules are very open compared with other forests throughout the country, and these are putting our workers and our owners at risk.

While the Trustees do want to make it as easy as possible for our owners to access their lands, they also are very aware of their obligation to protect everyone who goes onto the lands — be it for work or recreation. It is clear that our current rules, which allow recreational access in daylight hours seven days a week, are not achieving this.

We typically have around 200 people working in our forests on any day. While many are highly visible, such as those in harvesting gangs, there are others who are less so, such as pruning gangs and people doing mensuration (measuring the forest for various factors). In addition, there is the heavy use of our forest roads – around 100 logging trucks a day on average, plus the vehicles used by the forest workers, the forest managers, the many entities who support the harvesting crews, and the third parties who have access rights, such as power companies and, in some instances, the Department of Conservation.

We have had many incidents such as near misses between recreational users and logging trucks, recreational users driving through the middle of harvesting operational areas and hunters firing guns close to silvicultural workers. Thankfully, there have not been any serious accidents, but that is through luck, and it is only a matter of time before something unfortunate happens.

While most workers will be out of the forest by 4 p.m. on weekdays, workers and logging trucks may still be in the forest, so owners must still be careful.

The change is consistent with the Trustees’ vision of becoming a world-class indigenous-owned forestry business creating intergenerational value. The two Trusts’ businesses are large – with annual log sales of over $80 million and forest investment of over $6 million/year – and they demand professional management. To date, the two Trusts have provided owners with over $75 million in distributions and grants. It is essential we maintain our licence to operate if we are to continue providing these benefits.

The Trustees are very aware that some owners will be disappointed at having their access hours restricted. As a partial compensation for this inconvenience, the Trustees have agreed to extend the length of time Lake Taupō Forest Trust permits are valid to 4 weeks – the same duration that already applies to Lake Rotoaira Forest Trust permits.

While the Trust is responsible for significant commercial forestry activities on our lands, there is also a strong recognition of the need to protect and enhance the taonga tuku iho, and indeed the Trust Order and the Crown lease also emphasise these imperatives. The Trustees want to ensure that the land, and everything on it, including those who work and play on it, is managed in a sustainable way consistent with the principles of kaitiakitanga. Like most parts of the country, our land and forests suffer from pests, particularly possums, stoats and rats, and invasive weed species. The Trust is working to reduce the damage caused by these, and some of the initiatives are outlined below.

Lake Taupō and Lake Rotoaira forests received Forest Stewardship Council (FSC) certification in March 2002. This is a voluntary initiative under which independent auditors assess our forests and their management against a set of environmental, economic, social and cultural criteria. As well as providing independent confirmation that our forest and lands are being managed in a sustainable manner, FSC certification is increasingly being requested in the markets where wood products made from our logs are ultimately sold – particularly the United States and Europe. FSC certified wood is increasingly being demanded in Asia also, generally because it will be used to make products that are re-exported to the United States and Europe.

Several initiatives are being undertaken to better understand our environment, and information on our forest and associated ecosystems is steadily building.

Together, these help us ascertain and confirm the sustainability of our land, forest and ecosystem management. Many of these initiatives started prior to FSC certification, and many are also simply part of the day-to-day management of the forest, so it is difficult to be definitive on whether the work is specifically a result of our being FSC certified.

The Trustees are also keen to give owners and descendants of owners employment opportunities in the forest and on the land. This is consistent with the desires expressed at the outset of the Crown lease in 1973, and the feedback we get from our owners indicates it continues to be important today. These social and cultural imperatives are also consistent with the objectives of FSC.

Work on environmental and social initiatives over the last year has included the following actions.

NZ Forest Managers Annual Workforce Survey

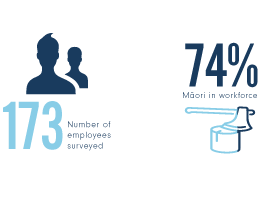

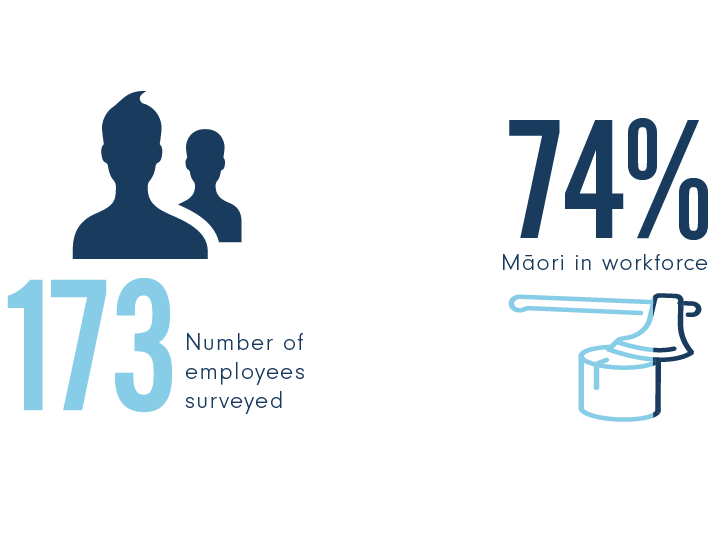

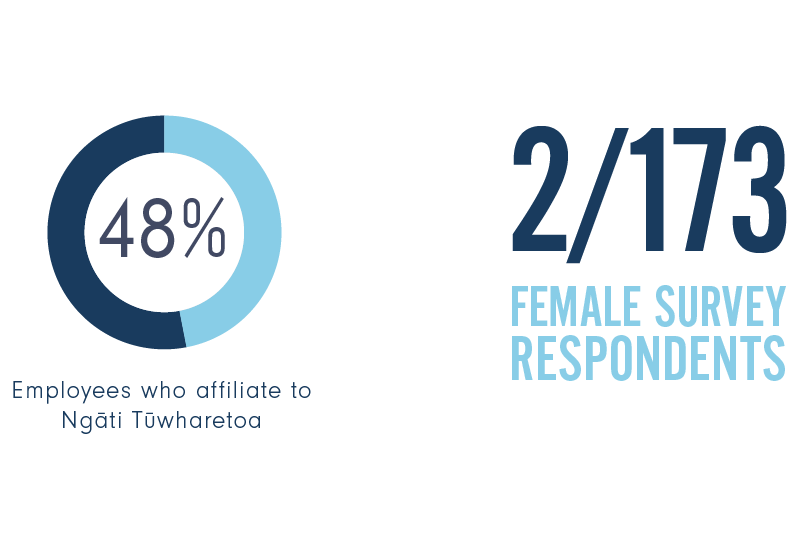

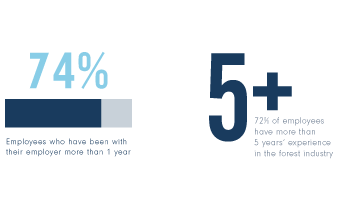

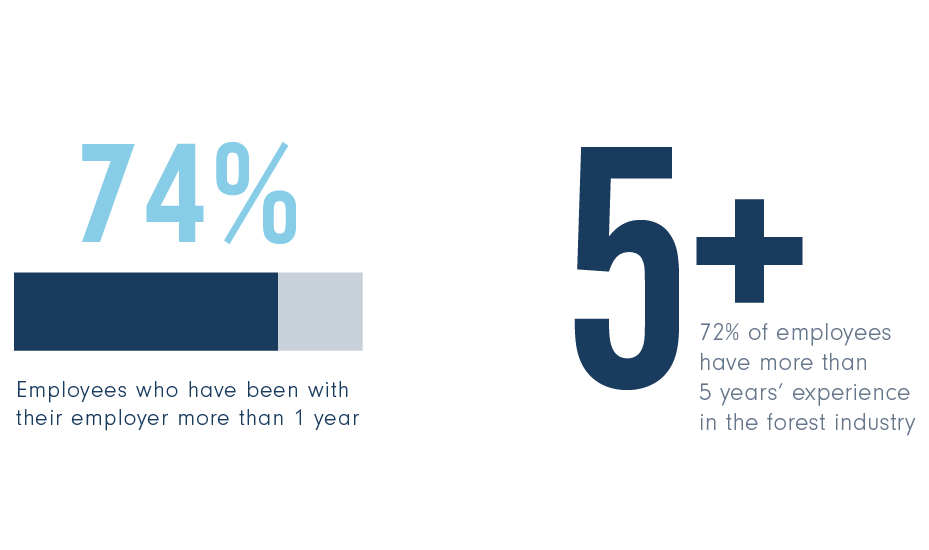

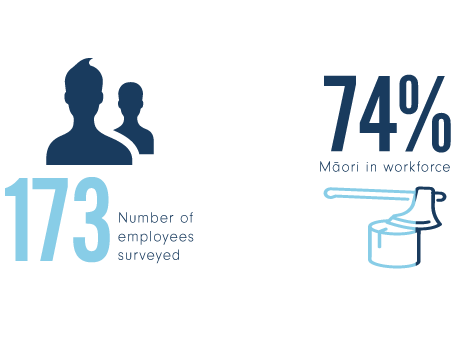

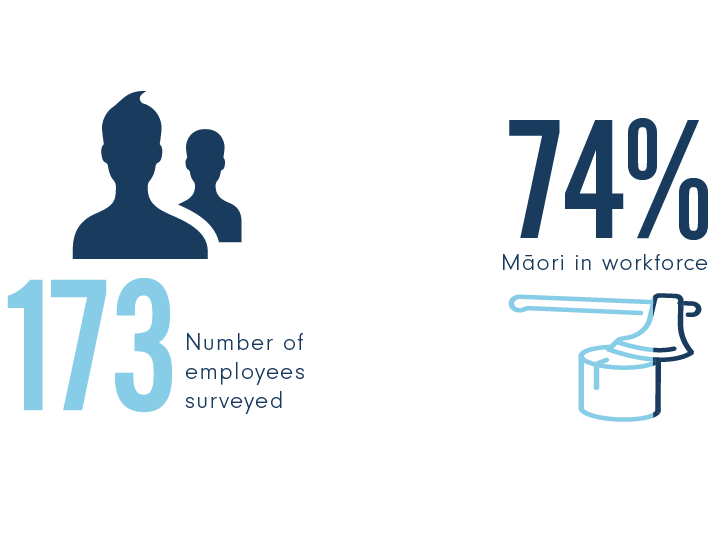

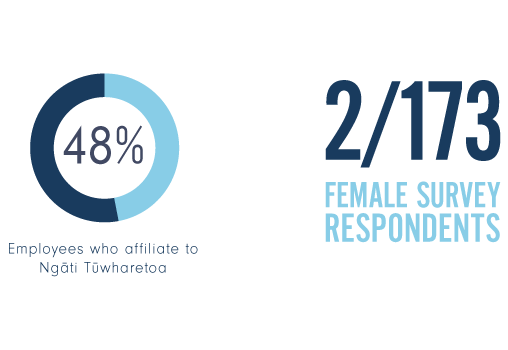

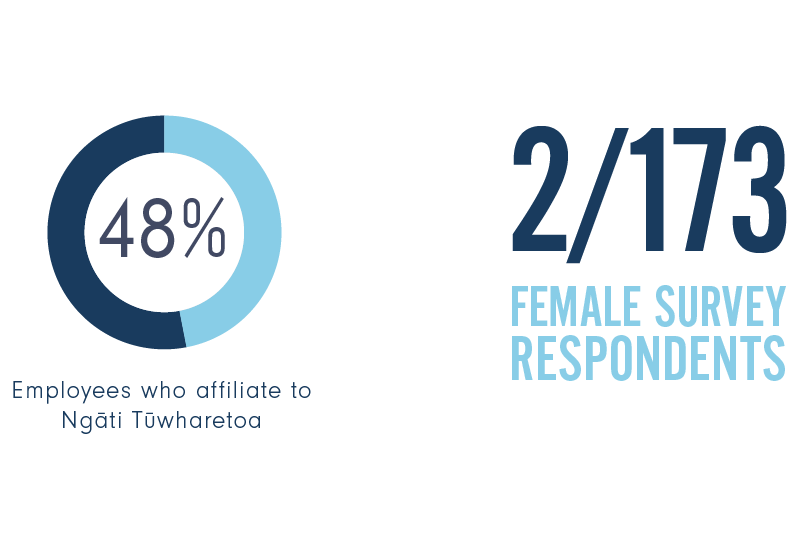

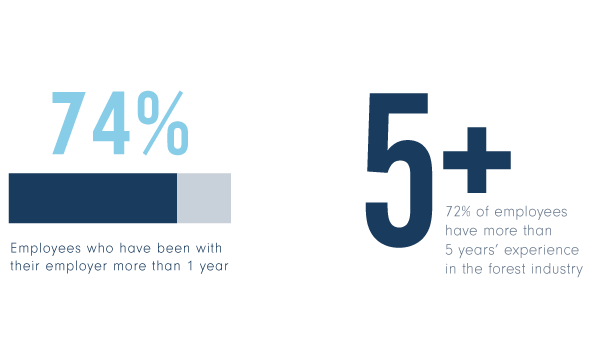

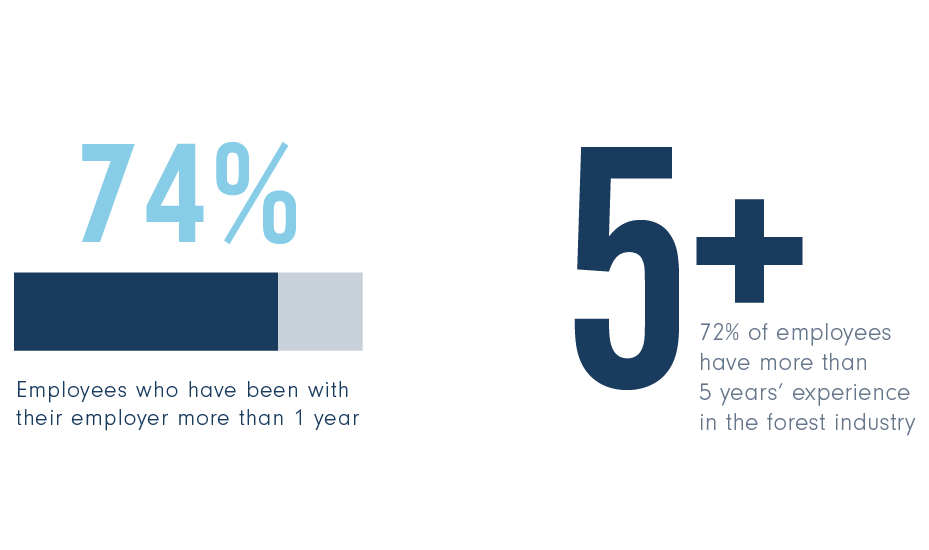

The NZ Forest Managers workforce survey is completed annually by the workforce in Lake Taupō and Rotoaira forests. Data is collected on a number of topics and various trends are analysed, such as local employment rates, crew turnover rates, the number of dependants supported from the forest, other uses of the forest, training courses completed and qualifications held.

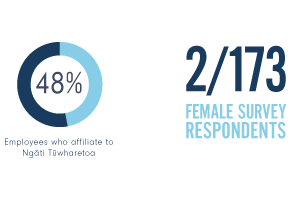

The 2016 survey returns showed trends similar to those in recent years. In most categories, the Trust is happy with the outcome – such as the proportion of Māori workers and the number of Tūwharetoa workers and owners – though we are always keen to get an even greater proportion of our own working in the forests. One statistic that we need to improve is the number of women working in the forest: for the second year running, only two of the respondents were women.

Integrated Pest Management Strategy

The following operations took place in Lake Rotoaira Forest in 2016–17:

Rotoaira Wetlands – Grey Willow Control

The treatment of willows was a coordinated operation with the Waikato Regional Council and neighbouring landowners. The operation includes annual surveys of the Rotoaira Wetlands to identify and record any new willows and areas of reinfestation.

After several years of active control, the populations in Rotoaira have been reduced to the point where only maintenance operations are required to keep on top of the willows. Surveys of the wetlands will continue to be implemented each year to monitor willows, with the next round to be done in conjunction with work the Department of Conservation is undertaking nearby.

Management of Rare, Threatened and Endangered Species within Lake Rotoaira Forest

Pittosporum turneri

Surveys of the rare Pittosporum turneri, which are on Lake Rotoaira Forest Trust land near Lake Otamangakau, showed an increase of possum browse, and it was considered likely that the health of the remaining trees would decline and trees may start to die. Consequently, an intensive possum control was established, which started in October 2016.

The control programme included the establishment of bait stations and A12 resettable traps. By February 2017, only two possums had been caught though more were identified on a digital counter set up in the vicinity. These results are standard for low or very low possum populations. The operation is continuing.

Dactylanthus taylorii

Dactylanthus taylorii is present in a number of native bush areas in Lake Rotoaira Forest, and the population near Otara Stream is considered to be the largest and healthiest. This population has a low percentage of dead plants and a high number of female plants, while others are less healthy and often suffer from browse by possums and pigs. Management intervention, such as trapping possums and installing cages over plants to prevent browsing, can assist to sustain and restore populations.

Ecologist Nick Singers is managing the Dactylanthus project in Lake Rotoaira Forest. Unfortunately, the trial area in Rotoaira Forest faced another challenging year, and most of the plants showed signs of browsing. Pollination was also low. This was likely to be the result of there being few natural pollinators (i.e., bats) and the wet flowering season, which causes Dactylanthus flowers to rot quickly.

NZ Long-tailed Bats

NZ Forest Managers conducted a survey to assess the presence and distribution of bats in Rotoaira Forest in 2003, repeating it in 2012 and in January 2017. The aim is to record changes in distribution across the Rotoaira Forest and gather information on the effect of harvesting and replanting on bat distribution.

The assessment showed there is continuing variation in activity levels between sites and years, and there are small changes in distribution between all survey years. Rotoaira Forest may be a favourable habitat for long-tailed bats, given the forest’s mosaic of roads, tracks, streams, wetlands, mature pine forest and native forest areas. However, activity levels indicated that the bats’ use of the forest is erratic, suggesting that bats in Rotoaira Forest are vagrants that range outside their core population’s home range. This hypothesis can only be proven by repeating surveys at regular intervals and comparing the activity levels over a greater period of time.

Indigenous Forest Health Surveys

The primary objectives of the forest health assessment were to compare the condition of important native vegetation types and tree species with results from the reassessment in 2014 and to identify any significant threats to the integrity of these forests so that management action can be considered.

The results indicate that little change has occurred since the last survey, and the overall forest health is considered fair to good. Browsing animals remain the main concern and are the primary driver of the decline in regeneration and understorey health. It is recommended that hunting continue in podocarp/hardwood forests to control large browsing animals.

Heather is still the greatest threat to native scrubland vegetation, and it is recommended that the biological control initiative for heather, led by the Department of Conservation, be considered.

2017 FSC Surveillance

The annual NZ Forest Managers FSC reassessment took place 13–16 February 2017. The reassessment was very successful, and no Corrective Action Requests (CARs) were raised. The auditors made four observations during the reassessment process. We have considered these observations and have started to address them in the areas of forest management that they apply to.

Many of the environmental initiatives are managed by our managers, NZ Forest Managers Ltd, and a large part of the certification workload also falls on this company. Their website, www.nzfm.co.nz, outlines all NZ Forest Managers’ operations, and is useful for checking progress on the Trust’s FSC initiatives.

It is now two years since the two Trusts invested in Hautū Rangipō Whenua Ltd (HRWL), the company that purchased the Corrections lands near Tūrangi and the neighbouring Mangamawhitiwhiti Farm. The Lake Rotoaira Forest Trust has an 18.2 per cent share of HRWL, and the Lake Taupō Forest Trust has a 42.3 per cent share. These two shareholdings are managed through the two Trusts’ subsidiary company Lake Taupō Forest Management Ltd. The other HRWL shareholders are the Tūwharetoa Settlement Trust (19.7 per cent) and three farm trusts, Waihi Pukawa, Puketapu 3A and Oraukura 3, each with 6.6 per cent.

The purchase secured the lands back into Tūwharetoa ownership, and this was a key consideration for all the investors. In addition, the purchase will, in time, increase the scale and efficiency of the Trusts’ forestry businesses, and it also opens up the ability to take advantage of other synergies between the two Trusts.

HRWL continues to operate successfully. It adheres to the general approach of being a passive land owner that leases the lands out to other users. Of the approximately 9,000 hectare estate:

The remaining lands are non-productive though they do generate income through bee-keeping leases.

HRWL is continuing to look at options for the four 60-bed prison units and the associated buildings it has inherited. Most, however, are in a very poor state of repair, and any ongoing use will not only require considerable investment but also require maintaining quite onerous and expensive resource consents for waste-water disposal and for power supply. Some are able to be relocated, and we are getting quotes for this to be done. We will then offer them to the local hapū and the HRWL partners.

The Lake Rotoaira Forest Trust and Lake Taupō Forest Trust effectively have two components to their investment:

The forestry and undeveloped parts of HRWL’s land will soon become available for recreational access. All Lake Taupō Forest Trust and Lake Rotoaira Forest Trust owners will be eligible for access onto the lands, as will owners in the farm trusts and members of the eight hapū with mana whenua over the lands. Access will be managed under a block system, available through a ballot process and only on weekends. The land will be divided into four blocks: three available under the ballot and one reserved solely for the eight local hapū, which will be able to access the block to gather kai for tangihanga.

The development of the online access and ballot system has been disappointingly slow, but it is hoped that ballots for access for at least some of the blocks will start in early 2018. The tangihanga block has already been used on occasion, but the procedure for organising this still has some final development to be completed.

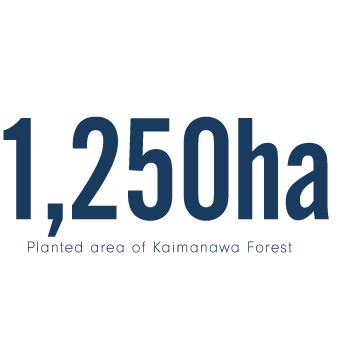

Lake Taupō Forest Management Ltd, on behalf of its parent entities Lake Rotoaira Forest Trust and Lake Taupō Forest Trust, is creating Kaimanawa Forest on the Hautū Rangipō Whenua land. The investment is funded 30 per cent by Lake Rotoaira Forest Trust and 70 per cent by Lake Taupō Forest Trust, and it is formalised through a Forestry Right Agreement held by Lake Taupō Forest Management Ltd. Lake Taupō Forest Management Ltd pays an annual rental to Hautū Rangipō Whenua Ltd (HRWL) for the use of the land for this forest. However, because of their ownership of a significant shareholding in HRWL, the Trust effectively gets a good portion of this rent back.

At present Kaimanawa Forest has a planted area of around 1,250 hectares, comprising around 1,000 hectares of land that was previously in pasture and has now been afforested and around 250 hectares of forest harvested by the previous owner, New Forests Ltd, which has since been replanted by Lake Taupō Forest Management.

The planting into pasture programme will be completed in the winter of 2018, by which time it will total around 1,400 hectares. The replanting of the existing forest will take around 30 years to complete, and by then, it will total around 4,100 hectares. The eventual area of Kaimanawa Forest will be around 5,500 hectares, which will add around 17 per cent to the combined Lake Rotoaira Forest Trust and Lake Taupō Forest Trust forest area.

The two Trusts invested $669,000 (including rent) on developing Kaimanawa Forest in 2016–17. Lake Rotoaira Forest Trust’s share of these costs was around $201,000. Kaimanawa Forest was valued at $1.19 million at 30 June 2017. Lake Rotoaira Forest Trust’s 30 per cent share of this value is around $0.36 million.

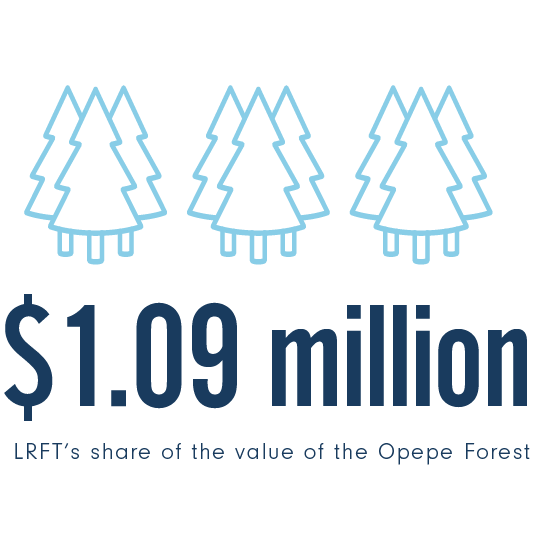

The joint forestry investment on Opepe Farm Trust lands by the Lake Rotoaira and Lake Taupō forest trusts is progressing well. This investment is funded 30 per cent by Lake Rotoaira Forest Trust and 70 per cent by Lake Taupō Forest Trust, and is formalised through a Forestry Right Agreement held by Lake Taupō Forest Management.

The project commenced in 2012 and has involved the forest Trusts purchasing 250 hectares of young trees from Opepe Farm Trust, replanting 650 hectares of harvested forest over the next three years and undertaking new planting of around 500 hectares of pasture land. The total area of the forest is around 1,400 hectares.

During 2016–17, the two Trusts spent a total of $232,000 on planting, releasing, thinning and rent. Lake Rotoaira Forest Trust’s share of these costs was around $70,000. Harvesting is scheduled to start in 2038, and it should be complete by around 2045.

The Opepe Forest was valued at $3.64 million at 30 June 2017. Lake Rotoaira Forest Trust’s 30 per cent share of this value is around $1.09 million.

The Emissions Trading Scheme (ETS) is the New Zealand Government’s response to global climate change. It is a scheme under which industries that emit greenhouse gases, such as those producing oil and power and most other industries, have to offset their emissions through buying carbon credits. Forests absorb greenhouse gases out of the atmosphere and help reduce the impact of climate change. The world wants more forests, which has led the Government to introduce rules that ensure forest area is not reduced and encourage more forests to be established.

The ETS as it relates to plantation forestry divides plantations into two categories: pre-1990 forests and post-1989 forests. All of Lake Rotoaira Forest was established before 1990, so it qualifies as pre-1990 forests.

The ETS locks pre-1990 forest land into forestry by requiring payment of a deforestation tax if the land is not replanted after harvest. As partial compensation, owners of these lands were awarded carbon credits, which they can sell to industries that emit greenhouse gases. The Trust has around 9,180 hectares of pre-1990 forest registered under the ETS, and, in return, the Trust has received 551,000 carbon credits (known as New Zealand Units or NZUs).

The Trust met with the Waione Incorporation owners to discuss their NZUs. Waione is the only Lake Rotoaira Forest Trust block that leases its land to the Trust; all of the other blocks come directly under Lake Rotoaira Forest Trust itself. As Waione shares in all the benefits of the Trust, particularly in any distributions, it agreed to transfer its 31,000 NZUs to the Trust to ensure it contributes to the Trust in the same way as the other blocks. Lake Rotoaira Forest Trust now holds a total of 582,000 NZUs.

The Trustees have not yet decided what they will do with their allocation of NZUs though it is likely that most will be sold over a period of time. Just like log sales, the value of the NZUs can be expected to vary over time in line with changes in demand and supply. Over the period 2011–15, a combination of the global financial crisis and the New Zealand Government not restricting the ability to trade other international versions of carbon credits led to a steady fall in the value of NZUs. From being traded at around $20/NZU in early 2011, prices rapidly fell through that year, and for most of the last four years were trading in the $3–$5/NZU range.

Since late 2015, the New Zealand Government has strengthened its commitment to the ETS, and it has also stopped the ability to use cheap offshore carbon credits to offset emissions. This has led to a steady increase in NZU values, and at September 2017, they are trading at around $18/NZU. At this price, Lake Rotoaira Forest Trust’s full pre-1990 NZUs allocation is valued at around $10 million.

‘The Trustees have not yet decided what they will do with their allocation of NZUs though it is likely that most will be sold over a period of time.’

The allocation of NZUs to the Trust’s pre-1990 forests was a one-off event. NZUs can only be sold once, so when and how many to sell are therefore key decisions. With the recent price rises, the Trustees have agreed that prices for NZUs are again at a level where we need to develop a policy on whether, when and how we may sell at least some of our units. Together with the Lake Taupō Forest Trust, we are taking advice from a variety of sources to identify and develop the best marketing strategy, with the objective of maximising the returns to the Trust.

Many commentators believe that the value of NZUs will continue to climb in forthcoming years though the government has effectively set a price cap of $25/NZU by offering to create more units if it reaches that level. Beyond 2021, there are other uncertainties over the market, both in the New Zealand Government’s domestic trading rules and internationally in terms of whether and which international carbon credit units may be allowed to be traded here. Despite these uncertainties, the general consensus is that prices are likely to rise.

Another factor that will influence the Trust’s sales of NZUs is its own cash flow forecasts. We know that the Trust will face fairly tight cash flows towards the end of the Crown lease (mid-2020s) as we will have an increasingly large forest estate to manage while our income is effectively fixed at 28.5 per cent of stumpage. It is quite possible that at least some of our NZUs may be sold to assist our cash flow through this tight period.